The Inflation Reduction Act of 2022 increased financial incentives for energy-saving heat pumps. Here are the heat pumps that qualify.

If you’re thinking about installing a super-efficient heat pump HVAC system or a heat pump water heater, you’re in luck.

Now is an excellent time for Americans to make their homes more comfortable and energy efficient.

When the Inflation Reduction Act was passed in 2022, it included financial incentives for home energy upgrades, including increased tax credits and new rebates for heat pump appliance upgrades.

But before you dive in, here’s something you need to know: Depending on where you live, you could get a super-efficient electric heat pump HVAC system or water heater—along with any eligible rebates you might qualify for and an energy-savings guarantee if you qualify. Tap here to find out.

Table of contents:

- How much is the heat pump tax credit for HVAC and water heater upgrades

- What heat pump rebates are included in the Inflation Reduction Act

- HVAC heat pump rebates

- Heat pump water heater rebates

- What heat pump HVAC systems qualify for incentives

- How to get the heat pump tax credit

- Heat pump rebates: Who qualifies

- Heat pump installation with an energy-savings guarantee

- FAQs about heat pump tax credits and rebates

Key points:

- The federal government is incentivizing energy-efficient upgrades, clean energy use, and renewable energy investments through the Inflation Reduction Act. Americans directly benefit, as this helps offset energy upgrade installation costs and reduce energy bills.

- The Energy Efficient Home Improvement Credit increased for American taxpayers starting in 2023, but to be eligible you have to install a qualified heat pump.

- On November 18, 2022, announcements were made regarding which heat pump HVAC systems will qualify for the new federal tax credits. We have an easy-to-understand breakdown below.

- You may be able to get a high-performance heat pump HVAC system or heat pump water heater installed with an energy-savings guarantee if your house qualifies through Sealed (in addition to new heat pump tax credits and rebates you may be eligible for!). You’ll pay for the work done in a way that works best for you and your budget. Discover how.

How much is the heat pump tax credit? Quick cheat sheet

HVAC system heat pump tax credits

- 2022: Up to $300

- 2023 through 2032: 30% of your project costs, up to $2,000, with an additional $600 tax credit for electric panel upgrades (if needed to support heat pump installation)

Heat pump water heater tax credits

- 2022: Up to $300

- 2023 through 2032: 30% of your project costs; up to $2,000, with an additional $600 tax credit for electric panel upgrades (if needed to support heat pump installation)

A new study shows modern heat pumps are not only reliable in cold weather, but also outperform fossil-fuel heating in the cold.

Canary Media

If you installed a qualifying heat pump HVAC system or water heater in 2022 or earlier, you may be eligible for a tax credit of up to $300.

But beginning in 2023, you could be eligible for a tax credit of up to $2,000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the Inflation Reduction Act. This annual credit is capped at $2,000.

To learn more about why heat pumps are such a smart energy-efficient home investment, check out our Guide to Whole-House Heat Pumps and our Heat Pump Water Heater Guide.

What heat pump rebates are included in the Inflation Reduction Act?

In addition to tax credits, the new heat pump rebates under the Inflation Reduction Act will be based on a variety of factors, including annual household income and energy savings.

We’ll talk more about this below, but here’s some high-level info you need first. The Inflation Reduction Act created two separate rebate programs:

- The HOMES rebate program, which is not income based. States are still working to decide how they will go about this program, and there are two pathways: measured savings and modeled savings.

- The HEEHRA rebate program, which is for low- to moderate-income households. This program is also known as the High-Efficiency Electric Home Rebate Act, HEAR, or the Home Electrification and Appliance Rebate Program.

How much are federal heat pump rebates? Quick cheat sheet

2023–2032 federal heat pump rebates for low- to moderate-income households max out at:

- $8,000 for an electric heat pump HVAC system

- $1,750 for a heat pump water heater

- $4,000 for an electric panel upgrade (if needed to support heat pump upgrades)

- $2,500 for an electric wiring upgrades (if needed to support heat pump upgrades)

Income-based rebates under the HEEHRA program could cover:

- Up to 100% of the project costs for low-income households, up to $14,000. These are households who earn no more than 80% of the area median Income.

- Up to 50% of the project costs for moderate-income households, up to $14,000. These are households who earn more than 80% and less than 150% of the area median Income.

To estimate if you fit these guidelines, take a quick peek at the Fannie Mae Area Median Income Lookup Tool, and then pop right back here for more info on heat pump rebates!

2023–2032 federal heat pump rebates that are NOT income-based:

Eligibility for the HOMES rebate program is not based on income. However, states are still working on guidelines for this program, which offers two ways to reward home energy savings from your upgrades.

If your state offers the HOMES measured pathway:

- The more energy you save, the higher the rebate! States are still defining the HOMES program. We’ll update this article as soon as more information is released.

If your state offers the HOMES modeled pathway, you could receive either a:

- $2,000 rebate for upgrades that are estimated to reduce energy use by 20% to 33% or

- $4,000 rebate for upgrades that are estimated to reduce energy use by 35% or more

Your State Energy Office (SEO) should have more detailed final guidelines coming out in early 2024 for both the HOMES and HEEHRA rebate programs, but final program guidelines will vary by state.

We cannot stress this enough: If you’re counting on using federal heat pump rebates for your project, check with your State Energy Office before you make your appliance purchase.

One more thing: The HEEHRA program (also referred to as the HEAR program) will not offer rebates retroactively for 2023 home energy upgrades.

According to the EIA, 51% of your home’s energy use is for heating and cooling alone. Heat pumps are pros at cutting energy waste!

What heat pumps qualify for federal tax credits?

Okay, now that we’ve talked through new rebates that are available and had a high-level look at the 2023 heat pump tax credits, let’s dig into the details… more specifically, the heat pump HVAC systems that qualify for federal tax credits.

It all depends on the date of your heat pump installation.

Tap below to jump ahead:

2022 Heat pump tax credits and incentives

For heat pump HVAC systems installed before December 31, 2022, ENERGY STAR-certified models are eligible for the $300 Energy Efficiency Home Improvement tax credit (1).

Selecting a model with the ENERGY STAR rating keeps things pretty simple!

To find out if you qualify for the 2022 heat pump tax credit, check to see if your heat pump appliance is ENERGY STAR certified—and check with your tax pro. That’s it!

New Inflation Reduction Act heat pump tax credits: 2023 through 2032

Starting January 1, 2023, you may be eligible for the new and improved 25C Energy Efficiency Home Improvement tax credit, and it’s capped at $2,000 for heat pump HVAC systems.

To qualify for the 2023 heat pump tax credit, you need to know two things:

- What type of heat pump HVAC system (ducted or non-ducted) you plan to install, and

- If the heat pump HVAC system you are looking to purchase is eligible for the tax credit.

What heat pump HVAC systems qualify?

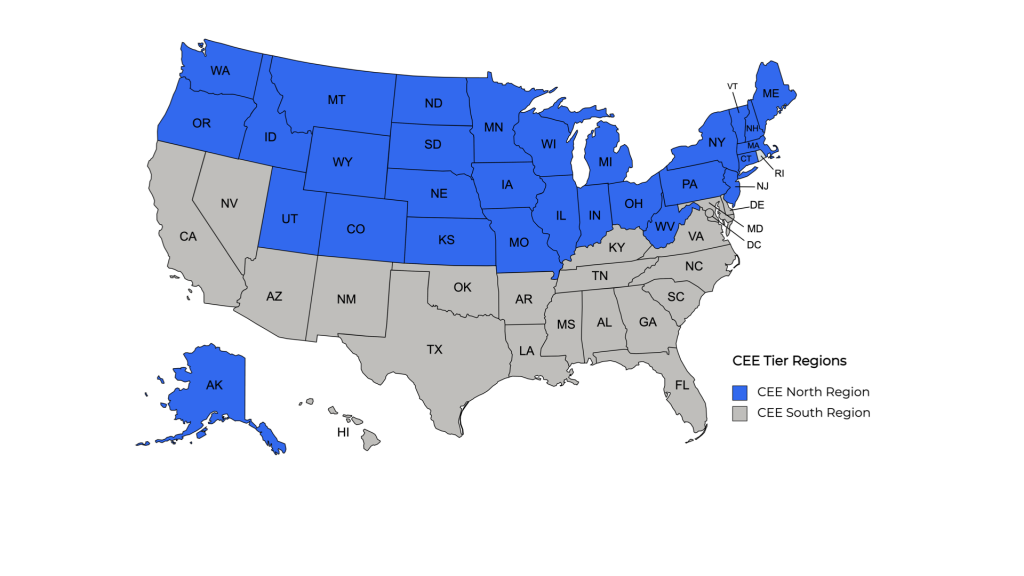

Heat pump eligibility for the tax credit (for HVAC systems specifically, heat pump water heaters don’t apply here as of the date of this writing) is tied to an industry efficiency ranking standard for technologies known as CEE tiers.

The CEE tiers are energy performance ratings developed by the Consortium for Energy Efficiency that appliance manufacturers can voluntarily choose to meet.

CEE adopted new tiers for 2023 on November 18, 2022, and the heat pump industry is working hard to identify which products meet the new eligibility criteria.

The good news is that when you install a CEE-eligible heat pump, you’ll benefit from exceptional energy efficiency and performance.

Who sets the CEE tiers—and how?

The Inflation Reduction Act gives the Consortium for Energy Efficiency (CEE) the responsibility of developing the guidelines for what is a ”tax credit eligible” heat pump.

The CEE is a professional group of energy efficiency program administrators and experts—think the leaders of your local electric or gas utility—who work together to advocate for energy efficiency policies and programs and advancement in home appliance technology.

One of the programs this group oversees is the “CEE tier” list—mentioned above—which ranks products based on how efficient they are.

Different types of appliances have different numbers of tier ratings, and the same is true for heat pumps.

This means to qualify for a heat pump tax credit for an HVAC system specifically, you need to purchase and install either:

- A ducted heat pump that meets CEE’s Tier 1 requirements for your state and region

- A ductless heat pump that meets CEE’s Tier 2 requirements for your state and region

Learn the difference between the two types in our Ultimate Guide to Heat Pumps.

The CEE also has an advanced tier, but it’s reserved for the next generation of heat pumps. (If you want to purchase and install one, that’s great! But you don’t have to in order to qualify for the 25C tax credit.)

You could cut up to 50% of your energy use when getting high-performance insulation, professional air sealing, and heat pump HVAC upgrades with Sealed. Learn how.

How do you get the heat pump tax credit?

In short, to maximize the value of your heat pump tax credit, you’ll need to owe at least $2,000 in taxes.

And to be eligible for the tax credit, you’ll need to make sure to report your heat pump home energy upgrades and provide whatever documentation is needed to prove your purchase at the end of the tax year.

Basically, all tax credits—including tax credits for rooftop solar and electric vehicle upgrades if you’re interested in those upgrades later—are a dollar-for-dollar reduction of the income tax you owe each year.

All of this red tape can get confusing, but never fear: If you work with Sealed for your home energy upgrades, we’ll make sure you have all the right paperwork for this step.

Remember, seek the guidance of a tax professional or financial advisor if you have any questions. (We’re home energy experts, not financial advisors!)

81% say their home comfort has improved by replacing their fossil fuel heaters with heat pumps.

Cool Products 2022 consumer analysis

How to apply for heat pump tax credits

To apply for the heat pump tax credit, you’ll simply need to indicate that you purchased and installed a qualifying heat pump HVAC system or heat pump water heater within the tax year and provide required information. (Save your receipts!)

Check with a local tax pro in your area to determine what additional information you may need.

How to get heat pump rebates

States will oversee the programs and applications for the new heat pump rebates. Right now, states are setting up their programs—so federal rebates will likely not be available until 2024.

But let’s pause for one moment: Energy rebates are different from tax credits.

You could get an energy rebate:

- At the time of purchase

- At the time of installation, or

- Post-purchase once your rebate application has been processed

Rebates usually require that you submit a completed application before you’ll receive the financial incentive. They’re not credits received on your annual tax return.

The application process depends on the specific rebate program you’re using and how your state or utility processes the program.

If you choose to get your upgrades with us, Sealed and your contractor will help you submit your application for a rebate.

Because states are developing new energy rebate programs and processes, being able to apply and obtain a rebate could take some time. Read IRA rebates and credits: 4 Hidden costs of waiting to learn more.

Remember: Check with your state energy office or local utility company to discover energy rebates that are currently available to you before you make your home energy upgrades. (But if you work with Sealed, we’ll make sure you’re getting all the rebates your project is eligible for.)

If the new federal rebates aren’t available in your area yet, and if you need a new water heater like yesterday, you may be able to get a heat pump water heater rebate through your utility company or a local program.

If you work with Sealed, we’ll make sure you’re getting all the rebates your project is eligible for.

And if your heating or cooling system is about to give out?

You shouldn’t wait to upgrade to a heat pump.

Same thing goes here: Check with your local utility or State Energy Office to see what rebate programs for heat pump upgrades may be eligible for you today.

Talk to Sealed. If you’re eligible to work with Sealed, we can help make sure you’re getting the energy upgrade incentives available in your area.

How to qualify for heat pump rebates under the Home Electrification and Appliance Rebate Program

To qualify for federal rebates under the income-based program, you’ll need to:

- Meet your state’s low- to moderate-income requirements for your household.

- Install a heat pump or heat pump water heater upgrade that is an ENERGY STAR-certified appliance. It’s easy! Just look for the ENERGY STAR certification before you decide on your heat pump (2).

- Follow any additional guidance or qualifications once released by your State Energy Office.

Check out our Inflation Reduction Act Home Improvement guide for in-depth, easy-to-understand guidance about the new home energy upgrade tax credits and rebates. Or read the IRA HOMES rebate program guide to learn about non-income-based new federal incentives.

Even if you don’t qualify for the income-based rebates, you can still save on your upgrades—especially once the HOMES rebate program is rolled out in your state. Plus, utility rebate options and manufacturer rebates are often available for heat pump appliances without having to wait.

Bonus: Financial incentives for insulation, air sealing, and weatherization upgrades are also available under the new laws. These improvements can extend the lifespan of your heat pump upgrade, optimize its efficiency, and improve your home’s comfort and health.

Learn more about how to get weatherization upgrades at no upfront cost here.

Get a heat pump with a guarantee—and save money with incentives you may qualify for

There’s a lot to consider when selecting and installing home energy upgrades (like high-performance heat pump appliances and what incentives are available!).

And there’s a lot to project-manage, too.

But when you work with Sealed, we make the process hassle free.

If your house is eligible, you can get an energy-efficient heat pump HVAC system or water heater—or both!—with flexible payment options. (Or pay cash, if that’s your thing!)

Plus, if your house needs it, you can get weatherization upgrades to optimize your heat pump and make your home healthier and more comfortable year round.

And at Sealed, we stay accountable to the results with our energy-savings guarantee, too. If you don’t save energy, we take the hit.

(No, it’s not too good to be true. Learn more here.)

Take our quick questionnaire to see if your house qualifies.

Discover more amazing heat pump appliance benefits. For more reading, check out:

- The ultimate guide to heat pump systems

- Ductless heat pumps: How do mini splits work?

- How to hide a mini-split unit

- The ultimate guide to heat pump water heaters

- Why converting from oil or switching from natural gas to an electric heat pump is a smart move

If I don’t have to spend any extra money to get a huge improvement to my home, it’s just a no brainer at that point.

Scott. R, Sealed customer

FAQs: Heat pump tax credits and rebates

Don’t see your question below? Talk to Sealed.

- What is the federal tax credit for installing a heat pump?

- Are there heat pump rebates that aren’t based on household income?

- Is a new HVAC system tax deductible in 2023?

- What HVAC system qualifies for tax credit 2023?

Q: What is the federal tax credit for installing a heat pump?

The 25c tax credit allows taxpayers to claim certain home energy upgrades, like heat pumps, to reduce their tax burden. In 2023, the maximum federal tax credit for installing a heat pump increased to 30% of your project costs—up to $2,000—under the Inflation Reduction Act.

Q: Are there heat pump rebates that aren’t based on household income?

Plenty of heat pump rebates aren’t restricted by household income, including from local utility companies and manufacturers. In addition, the Inflation Reduction Act legislation created the HOMES rebate program–which is still being sorted out by the states–is not income based.

Check out this HOMES rebate program guide to learn more, or tap here to see the quick list included in this article.

Q: Is a new HVAC system tax deductible 2023?

Yep! A new energy-efficient HVAC system could be tax deductible for you based on your financial situation, tax liability, and the type of HVAC system you install. (In our opinion, heat pumps are the way to go! They’re the most efficient heating and cooling system in one appliance).

Check with your tax professional or the IRS to be sure about your specific eligibility.

I wouldn’t hesitate to recommend Sealed for HVAC and insulation upgrades. If you’re looking to take on a large efficiency project for your home without the large upfront cost, Sealed is worth a look.

Matt R., Sealed customer

Q: What HVAC system qualifies for tax credit 2023?

In order to qualify for energy tax credits (also called the 25c tax credit), the HVAC system you’d like to install must meet certain efficiency standards, as measured by indicators like SEER and HSPF ratings. The easiest way to tell? Look for the ENERGY STAR label, or check out the ENERGY STAR product finder and filter the products by tax credit eligibility.

But remember: Heat pump HVAC systems are the future—and have the highest federal tax credits and rebate incentives available because they’re that good at cutting energy waste compared to boilers, furnaces, air conditioning units of the past. Learn more about heat pumps here.

Or skip the extra reading and see if you qualify to get a high-efficiency heat pump with Sealed—eligible rebates included. Plus, certain upgrades come with an energy-savings guarantee.

Ready to crunch the numbers?

Check out our home energy usage calculator to see where you could cut energy waste BIG TIME.

Tap here to try the home energy use calculator.